Bitcoin has reached an unprecedented milestone, surpassing $118,000 for the first time in its history. This surge comes after a prolonged period of stagnant trading, leaving many traders scrambling to adjust their strategies. So, what’s driving this explosive growth? A mix of factors including a weakening U.S. dollar, political backing, and favorable market conditions are creating a perfect storm for cryptocurrency enthusiasts. In this article, we will explore the dynamics behind Bitcoin’s remarkable rise and also touch on the broader implications for the cryptocurrency market.

The Forces Behind Bitcoin’s Surge

Several key factors are fueling Bitcoin’s impressive ascent. The combination of increased institutional interest through exchange-traded funds (ETFs) and the recent political climate has significantly boosted investor confidence. As more retail and institutional money flows into the market, Bitcoin’s price is being pushed to new heights.

Political Support: A Game Changer

Have you noticed how political attitudes can influence financial markets? The perceived support from the Trump administration for digital currencies has acted as a significant catalyst for Bitcoin’s rally. Recently, the Senate passed the GENIUS Act, which aims to regulate stablecoins. This legislation is expected to establish clearer guidelines for cryptocurrencies pegged to the dollar, thereby enhancing consumer trust in the market.

The Broader Market Impact

This rally isn’t limited to Bitcoin alone; it’s having a ripple effect across the entire cryptocurrency sector. Companies closely tied to Bitcoin are also seeing their stock prices rise. For instance:

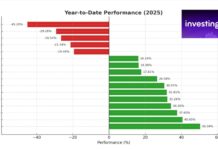

With Bitcoin boasting a year-to-date increase of 26% and a staggering 12-month return exceeding 100%, investor interest in the cryptocurrency market is being reignited.

Ethereum’s Struggles Amid Bitcoin’s Glory

While Bitcoin basks in the spotlight, Ethereum seems to be lagging behind. As of last Friday, ETH was trading at $2,989, showing a modest 4% increase over the last 24 hours and nearly 20% over the past week. However, it’s clear that the focus remains squarely on Bitcoin’s momentum, overshadowing Ethereum’s performance.

Investor Reactions: A Mixed Bag

Interestingly, Bitcoin’s meteoric rise hasn’t universally lifted all boats in the cryptocurrency market. Some companies closely associated with Bitcoin are thriving, while others are struggling. For example:

Yet, it’s worth noting that Circle’s stock remains significantly elevated, trading over six times its IPO price from just a month ago.

The Future of Cryptocurrency

As Bitcoin continues to break records, the broader implications for the cryptocurrency landscape are becoming increasingly evident. The evolving regulatory framework and growing institutional interest are likely to shape the future of digital currencies. With Bitcoin leading the charge, the question remains: how will other cryptocurrencies adapt in this rapidly changing environment?

Stay tuned, because the world of cryptocurrency is anything but static.