In a rapidly evolving financial landscape, eToro Group Ltd. has made headlines with its recent announcement regarding its performance for the fiscal year 2025 and the fourth quarter. As a leader in the online trading space, you might be curious about how eToro is adapting to an ever-changing market and what this means for investors like you. The company’s CEO, Yoni Assia, emphasized the launch of their global financial super-app, which integrates advanced AI capabilities and provides 24/7 access to a diverse range of assets. This article will unpack eToro’s latest results, including its growth in cryptocurrencies, stocks, and its innovative banking solutions, as well as the implications of its strategic decisions for the future.

Strong Financial Performance in 2025

For the fiscal year, eToro reported a solid 10% increase in net contributions, totaling $868 million. This growth reflects the company’s strategic initiatives and its commitment to enhancing user experience. Additionally, GAAP net income saw a rise of 12%, reaching $216 million, indicating robust operational performance. Adjusted EBITDA climbed to $317 million, with adjusted diluted earnings per share hitting $2.64. These numbers suggest that eToro is effectively navigating the complexities of the market.

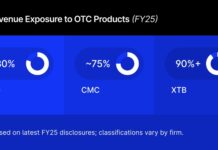

Diversification of Offerings Fuels Growth

eToro’s expansion strategy has been quite aggressive. They have broadened their reach to 25 stock exchanges, simultaneously increasing their cryptocurrency offerings to over 150 assets. This diversification is crucial for attracting a wider audience. The introduction of stock margin trading and the expansion of derivatives have further enhanced their service portfolio. Notably, eToro has also made strides in the UK and Australian markets by growing their ISA and savings products, catering to a broader range of investor needs.

Quarterly Insights: A Mixed Bag

When looking specifically at the fourth quarter, there was a 10% decline in net contributions, dropping to $227 million. However, GAAP net income increased by 16% to $69 million, which shows resiliency amidst challenges. Funded accounts grew by 9%, totaling 3.81 million, and the assets under administration reached a substantial $18.5 billion. These figures reflect a growing user base and an increase in investor confidence in eToro’s platform.

Strategic Partnerships and Expansion Efforts

To support its growth trajectory, eToro has formed partnerships with notable entities like BWT Alpine Formula 1 and Gemini Space Station Inc. Such collaborations are likely to enhance brand visibility and attract new customers. Furthermore, the company has been ramping up its neo-banking services, increasing the number of eToro Money accounts and transaction volumes, aligning with modern consumer needs.

Changes in Workforce: A Necessary Adjustment

Despite its successes, eToro has announced cuts to about 7% of its global workforce. This decision, as stated by CEO Yoni Assia, is a strategic move to ensure that the company is appropriately sized for its long-term objectives. Though this reduction could impact over 100 employees, it’s important to note that workforce adjustments are common in the brokerage industry. Other firms like IG Group and CMC Markets have also made similar moves, often citing advancements in technology and automation as contributing factors.

Share Buyback Initiative: A Show of Confidence

In a positive twist, eToro has boosted its share repurchase program by $100 million, bringing the total authorization to $150 million. This includes an accelerated buyback plan of $50 million. Such actions typically signal confidence in the company’s future and can be seen as a way to enhance shareholder value.

As you can see, eToro is navigating the complexities of the financial world with a mix of innovation and strategic decision-making. Keep an eye on how these developments unfold, as they may present new opportunities for investors like you.