Exness Blocks New Client Registrations in India: What You Need to Know

In a surprising move, Exness, a prominent retail broker, has halted the onboarding of new clients from India. This decision, which appears to have taken effect without any formal announcement, has left many users unable to create accounts. If you’re in India and trying to access Exness, you may have noticed that your attempts to register now redirect you to a simplified login page, devoid of any signup options. What’s behind this sudden change, and what does it mean for traders in India? Let’s dive deeper into the implications of this decision.

Current Situation for Exness Users in India

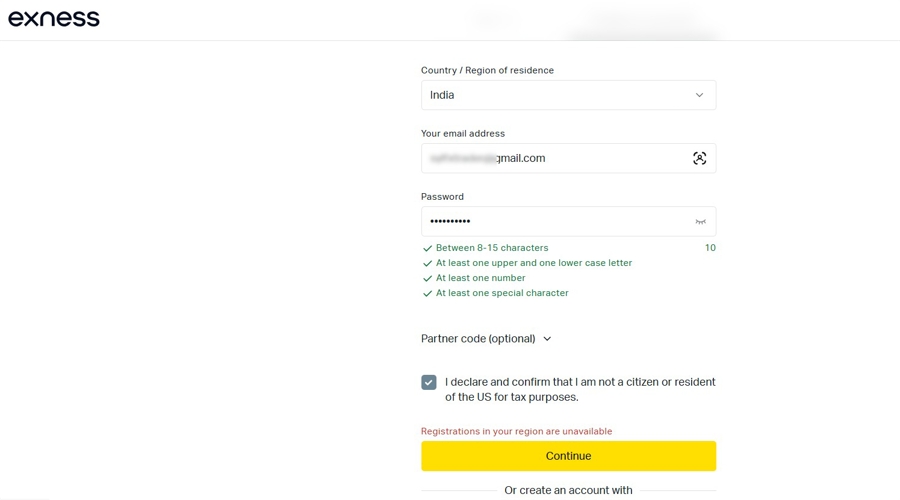

If you are an Exness user in India, you might be feeling frustrated right now. The inability to register for new accounts means that potential clients are facing barriers that didn’t exist before. Instead of the usual signup process, new users are met with a message stating that registrations are not available from their region. This sudden restriction raises questions about the broker’s future in the Indian market.

The Silence from Exness

Despite the significant impact on many traders, Exness has not provided any public comments about this restriction. This lack of communication leaves users in the dark regarding whether this change is temporary or permanent. For individuals and businesses that have established networks through the platform, such uncertainty can be unsettling. Musaddaq Shabir, a Business Development Manager at Neex, expressed concern, highlighting the trust and value built by users over time.

Regulatory Landscape in India

Interestingly, this restriction comes amidst increasing scrutiny from India’s securities regulator. Recently, the Securities and Exchange Board of India (SEBI) introduced a new payment verification system aimed at protecting retail investors. By mandating all registered intermediaries to adopt a standardized UPI payment handle, the initiative seeks to enhance trust and curb unauthorized brokers in the market.

The Impact of SEBI’s Regulations

These regulatory changes are crucial for ensuring that only licensed entities operate in the Indian financial landscape. With a growing number of unregulated derivative products being offered, the need for stringent guidelines has never been more apparent. This includes warnings from major stock exchanges like the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) about the trading of products like contracts for difference (CFDs).

What This Means for Traders

For many traders and introducing brokers (IBs) who have built their networks around Exness, this change could have significant repercussions. Managing client relationships in an uncertain environment can be challenging. It’s vital for IBs to explore alternative platforms or adapt their strategies to maintain client engagement.

Looking Ahead: The Future of Trading in India

As you navigate this evolving landscape, staying informed is essential. What steps will you take to adapt to these changes? Understanding the regulatory environment and exploring diverse trading options can help you make informed decisions moving forward.

While the current situation may seem daunting, it also highlights the importance of robust regulations designed to protect traders like you. Being aware of these developments can help you stay ahead in the ever-changing world of forex trading.