In the ever-evolving world of investments, 2025 has already made quite a splash. Whether you’re a seasoned investor or just dipping your toes into the market, understanding the biggest winners and losers this year can be crucial. Have you noticed how some commodities have skyrocketed while others have plummeted? This year’s market dynamics reveal stark contrasts, particularly among precious metals, agricultural products, and even cryptocurrencies. Let’s dive into the highlights and lowlights of 2025, offering you insights that could shape your investment strategies.

Major Movers of 2025: A Closer Look

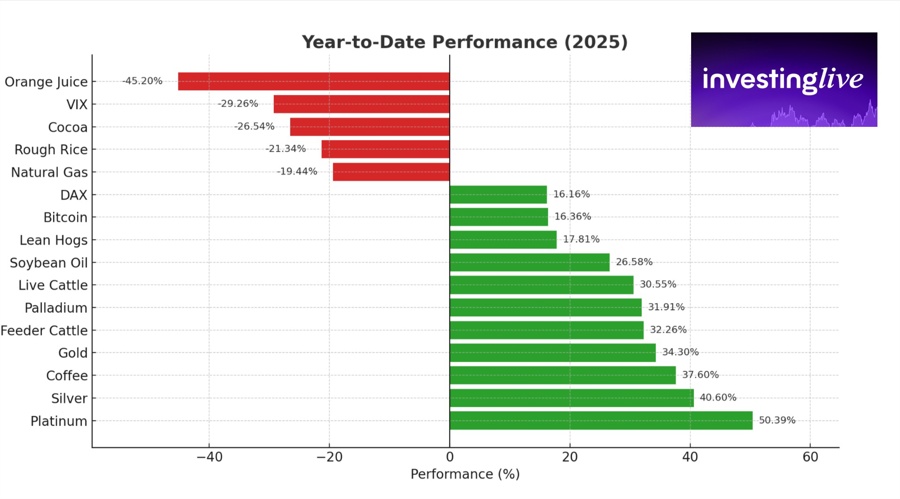

When it comes to standout performers, platinum has taken the crown this year with an impressive surge of 50.39% YTD. This remarkable rise can be attributed to a combination of heightened industrial demand and a flight to safety amid global uncertainties. Not far behind, silver has also shone brightly with a 40.6% increase, confirming that investors are actively seeking solid assets as they navigate shifting interest rates.

Conversely, some commodities are facing dramatic declines. Orange juice, for instance, has nosedived by 45.2%, essentially erasing last year’s gains. This serves as a reminder that even commodities that once thrived can experience rapid downturns. Additionally, the VIX—a measure of market volatility—has dropped by 29.26%, a trend that often signals more stable equity markets unless major disruptions occur.

Noteworthy Trends in Commodities

The broader landscape reveals even more fascinating trends. For example, gold has risen by 34.3%, and coffee has seen an uptick of 37.6%. These gains reflect a robust interest in agricultural products amid supply shortages. In fact, cattle markets have also enjoyed gains exceeding 30%**, further emphasizing the agricultural trend.

On the alternative assets side, Bitcoin has increased by 16.36%, while Germany’s DAX index has gained 16.16%. These figures highlight how digital currencies and equities are keeping pace with traditional investing avenues, making them worthy of consideration in a diversified portfolio.

Understanding the Losers: A Cautionary Tale

Beyond orange juice, several other commodities have seen declines. Cocoa has dropped by 26.54%, rough rice by 21.34%, and natural gas by 19.44%.** These declines are largely due to oversupply and weaker demand, contrasting sharply with the inflationary backdrop of 2024.

This disparity between winners and losers is not merely academic. It highlights the fragmented nature of today’s markets and underscores the importance of diversification.

The Importance of Diversification in Investing

The stark difference between platinum’s 50% rise and orange juice’s 45% fall emphasizes a crucial lesson: diversification is essential. As investors, you need to balance exposure across various asset classes. This doesn’t mean chasing every trend but rather aligning your investments with different economic drivers.

Safe-haven assets like precious metals can offer stability during times of uncertainty, while growth-linked commodities may capitalize on supply shortages and inflation pressures. By diversifying, you can better buffer your portfolio against extreme fluctuations, ensuring a more resilient investment strategy.

Understanding the market dynamics of 2025 can enhance your investment choices. So, as you contemplate your next move, consider these insights carefully. They just might help you navigate the complexities of today’s financial landscape.