In today’s fast-paced retail landscape, consumer expectations around checkout experiences are evolving rapidly. Whether you’re shopping online or in-store, how you pay has become a pivotal part of the buying journey. Recent findings from a comprehensive report highlight significant shifts in shopping behaviors, payment preferences, and security concerns among consumers across Europe. Have you ever wondered how your payment choices influence your shopping experience? This article delves into the latest trends, revealing insights that could reshape how retailers approach payments and security.

###

Understanding the Shift to Online Shopping

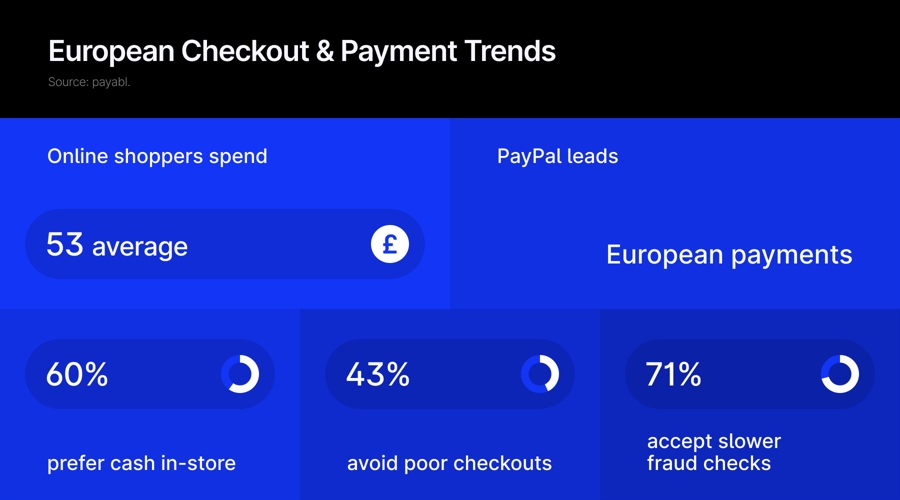

It’s no surprise that online shopping has become a staple for many consumers today. With nearly half of shoppers reporting that they make online purchases at least once a week, the digital marketplace is thriving. The average transaction amount stands at £53, with a notable 10% of consumers frequently spending over £100. Most people prefer to plan their purchases instead of making impulsive buys, often combining items to save on shipping or for eco-friendly reasons.

###

How Payment Preferences Differ Across Countries

When it comes to payment options, consumer satisfaction hinges on choice. PayPal continues to be the favorite across Europe, yet preferences vary significantly by country:

Shoppers prioritize speed, convenience, and security when selecting their payment methods. Interestingly, familiarity with a payment option is less critical; incentives like cashback or discounts can motivate consumers to explore new methods.

###

The Role of Cash in In-Store Purchases

Despite the rise of digital transactions, cash remains a popular choice for in-person shopping. Approximately 60% of surveyed consumers indicate a preference for cash when making purchases at physical stores. Notably, Germany leads with 67% favoring cash. This highlights a distinct gap between online and offline shopping behaviors.

###

The Impact of Checkout Experiences on Consumer Loyalty

Your checkout experience can significantly influence your likelihood of returning to a retailer. A staggering 43% of consumers admit that a frustrating checkout process would deter them from future visits. Common pitfalls include:

Surprisingly, 60% of consumers reported that they hadn’t abandoned a transaction in the previous six months, a stark contrast to retailers’ higher cart abandonment statistics.

###

Security: A Top Concern for Online Shoppers

Security remains a pressing issue for those shopping online. An impressive 71% of consumers are willing to tolerate a slower checkout process if it enhances fraud protection. However, opinions differ on who should shoulder the responsibility for preventing fraud:

This ambiguity underscores the necessity for businesses to communicate their fraud protection measures more effectively.

###

Growing Interest in One-Click Checkout

The concept of one-click checkout is gaining traction, with nearly 48% of consumers open to using it—provided it’s offered by reputable companies like Visa or Mastercard. However, about 23% remain resistant to this option altogether.

###

Recommendations for Retailers to Enhance Checkout Experiences

To keep pace with changing consumer expectations, retailers should consider adopting the following strategies:

By focusing on these areas, retailers can create a more satisfying shopping experience that addresses consumer preferences and security concerns.