In recent times, the cryptocurrency landscape has been evolving rapidly, with new platforms and services emerging to cater to the growing interest in digital assets. Have you ever wondered how these changes might affect your trading experience? One of the latest developments is the introduction of dedicated spot cryptocurrency exchanges, which are designed to provide users with a more streamlined trading experience. In this article, we’ll explore the launch of Pepperstone’s spot crypto exchange, its implications for traders, and the broader trends in the industry.

You’ll find insights about the new offerings, the challenges brokers face in this sector, and how the market dynamics are shifting. Let’s dive in!

Pepperstone Enters the Spot Crypto Market

Pepperstone has officially launched its spot cryptocurrency exchange, initially targeting Australian users. This platform features popular cryptocurrencies like Bitcoin, Ethereum, Solana, USDC, and USDT, all paired against the Australian dollar. With a competitive trading fee set at just 0.1%, this move is set to attract both novice and experienced traders alike.

The CEO, Tamas Szabo, emphasized that the exchange’s infrastructure was developed in-house. This decision was made to ensure tight control over critical aspects such as liquidity, execution, and security. Interestingly, Pepperstone will still continue to offer cryptocurrency Contracts for Difference (CFDs) separately, allowing users to choose the trading method that best fits their needs.

Trends in the Cryptocurrency Trading Sector

As the crypto landscape evolves, many CFD brokers are also making the leap into spot trading. Industry experts have pointed out that operational challenges remain significant, with factors like execution quality and compliance becoming increasingly important.

The rise in spot trading volumes and clearer regulatory frameworks have been key drivers of this shift. Brokers are currently weighing the benefits of developing in-house infrastructure against adopting white-label solutions. This balancing act involves managing custody, liquidity, and treasury responsibilities effectively.

Spot and Perpetual Trading Volumes Surge

Recent data reveals that the trading volume for spot cryptocurrencies reached an impressive $18.6 trillion, reflecting a 9% year-over-year increase. Meanwhile, perpetual contracts surged to $61.7 trillion, marking a 29% rise. Notably, Binance continues to dominate the market in terms of liquidity and reserves, showcasing the growing concentration of market power among leading platforms.

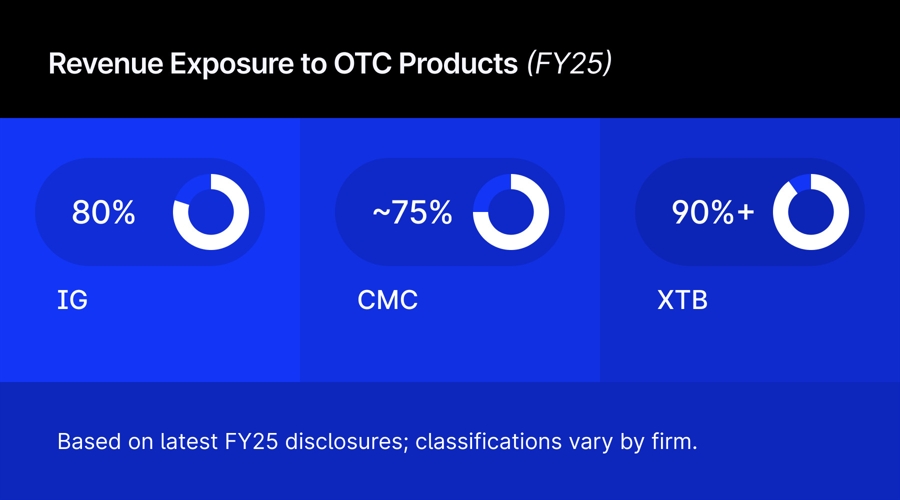

European CFD Brokers Adapt to Market Changes

In Europe, a similar trend is emerging as CFD brokers diversify their offerings to include exchange-traded futures and options. This shift is largely influenced by tightening regulations surrounding high-leverage over-the-counter products.

Transitioning to listed derivatives alters revenue models, pushing brokers to adapt. They are now less reliant on internal profits and more focused on generating income through commissions and additional services. Although profit margins per trade may decrease, this approach offers greater predictability and reduces regulatory risks.

Financial Results from Leading Brokers

Financial metrics from various brokers provide insights into how they are navigating this evolving landscape. For instance, Plus500 reported an annual revenue of $792.4 million, despite a 5% drop in active clients. Interestingly, the average deposit per customer rose dramatically, suggesting that existing clients are becoming more engaged.

In contrast, NAGA Group’s revenue remained stable, though they faced challenges like low market volatility and increased competition. Despite these hurdles, NAGA expects to see growth in the coming years.

Operational Risks in the Crypto Space

Recent events have highlighted operational risks within the cryptocurrency sector. A notable incident occurred with South Korea’s Bithumb, where an accidental distribution of over $40 billion worth of Bitcoin raised serious concerns about platform integrity. Although most of the funds were recovered quickly, the situation underscores the need for robust operational controls in crypto exchanges.

As the industry matures, addressing these risks will be critical to gaining user trust. Bithumb has committed to enhancing its verification processes and implementing AI technologies to better manage transactions.

Regulatory Changes on the Horizon

Regulatory frameworks in adjacent financial sectors are also evolving. In the UK, the Financial Conduct Authority (FCA) is set to regulate buy now, pay later (BNPL) services by mid-2026. This move aims to ensure that credit is only extended to those who can afford to repay it, reflecting a broader trend towards tighter regulation.

Events Shaping the Future of Trading

Finally, events like the iFX EXPO Dubai 2026 are bringing together industry leaders to discuss the future of trading. With sessions covering everything from trading fundamentals to the integration of AI in trading, these gatherings play an essential role in shaping market trends and fostering collaboration among peers.

In summary, the cryptocurrency trading landscape is undergoing significant changes, driven by new platforms, evolving regulations, and the convergence of traditional and digital trading strategies. Whether you’re a seasoned trader or a curious newcomer, staying informed about these developments will be crucial to navigating this dynamic market.